Section 179 Tax Deduction

If you're a business owner, Section 179 of the IRS tax code can offer unique benefits and advantages that can make your new vehicle purchase even more rewarding

What is the Section 179 Deduction

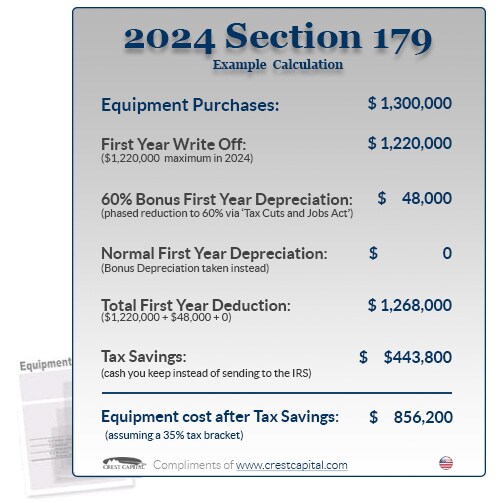

Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. It's an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

Today, Section 179 is one of the few government incentives available to small businesses, and has been included in many of the recent Stimulus Acts and Congressional Tax Bills. Although large businesses also benefit from Section 179 or Bonus Depreciation, the original target of this legislation was much needed tax relief for small businesses - and millions of small businesses are actually taking action and getting real benefits.

How It Works

In years past, when your business bought qualifying equipment, it typically wrote it off a little at a time through depreciation. In other words, if your company spends $50,000 on a machine, it gets to write off (say) $10,000 a year for five years (these numbers are only meant to give you an example). Now, while it's true that this is better than no write-off at all, most business owners would really prefer to write off the entire equipment purchase price for the year they buy it.

And that's exactly what Section 179 does - it allows your business to write off the entire purchase price of qualifying equipment for the current tax year.

This has made a big difference for many companies (and the economy in general.) Businesses have used Section 179 to purchase needed equipment right now, instead of waiting. For most small businesses, the entire cost of qualifying equipment can be written-off on the 2024 tax return (up to $1,220,000).

All vehicles used for business purposes qualify for a deduction for depreciation - although most passenger vehicles are limited by a maximum 1st year depreciation deduction of $20,200 while other vehicles that by their nature are not likely to be used more than a minimal amount for business purposes, may not qualify for the full Section 179 Deduction (full policy statement available at IRS.gov). But trucks with a GVW above 6,000 are eligible for the full 100% of the purchase price deduction if they are utilized exclusively for business purposes.

Note: The deduction for business vehicles is the same whether they are purchased outright, leased, or financed.

Limits

General Limits

Section 179 does come with limits - there are caps to the total amount written off ($1,220,000 for 2024 ), and limits to the total amount of the equipment purchased ($3,050,000 in 2024 ). The deduction begins to phase out on a dollar-for-dollar basis after this limit is reached by a given business (thus, the entire deduction goes away once $4,270,000 in purchases is reached), so this makes it a true small and medium-sized business deduction.

Limits for SUVs or Crossover Vehicles with GVW above 6,000 pounds

Certain vehicles like SUV's and Crossovers (with a gross vehicle weight rating above 6,000 lbs. but no more than 14,000 lbs.) may qualify for Section 179 or Section 168(k) "Bonus Depreciation" allowing for a business to deduct up to 100% of the purchase price in the current tax year provided the vehicle is purchased and placed in service prior to January 1, 2024, and it meets other conditions.

Who Qualifies for Section 179?

All businesses that purchase, finance, and/or lease new or used business equipment during tax year 2024 should qualify for the Section 179 Deduction (assuming they spend less than $4,270,000). Most tangible goods used by American businesses, including "off-the-shelf" software and business-use vehicles (restrictions apply) qualify for the Section 179 Deduction.

For basic guidelines on what property is covered under the Section 179 tax code, please refer to list of Section 179 Qualifying Equipment. Also, to qualify for the Section 179 Deduction, the equipment and/or software purchased or financed must be placed into service between January 1, 2024 and December 31, 2024.

For 2024, $1,220,000 of assets can be expensed; that amount phases out dollar for dollar when $3,050,000 of qualified assets are placed in service.

Ford Vehicles that Qualify for Section 179 Deduction

Ford trucks and SUVs have earned a renowned reputation for potent performance, robust durability, and tremendous value when compared to the competition. The following Ford vehicles qualify for Section 179 deduction.

- Explorer (2WD and 4WD)

- Expedition (2WD and 4WD)

- F-150 (and larger) (2WD and 4WD)

Other Considerations

- Vehicles MUST be titled in the company name (not in the company owner's name).

- The vehicle must also be used for business at least 50% of the time - and these depreciation limits are reduced by the corresponding % of personal use if the vehicle is used for business less than 100% of the time.

- You can only claim Section 179 in the tax year that the vehicle is "placed in service" - meaning when the vehicle is ready and available - even if you're not using the vehicle. Further, a vehicle first used for personal purposes doesn't qualify in a later year if its purpose changes to business.

How can we help?

* Indicates a required field

-

Kinley Ford

301 South Front Street

Hamburg, PA 19526

- Sales: 610-929-3683